BMW NA Q3 2025 Gross sales: Massive Positive factors Throughout the Board, However EV Momentum Eases

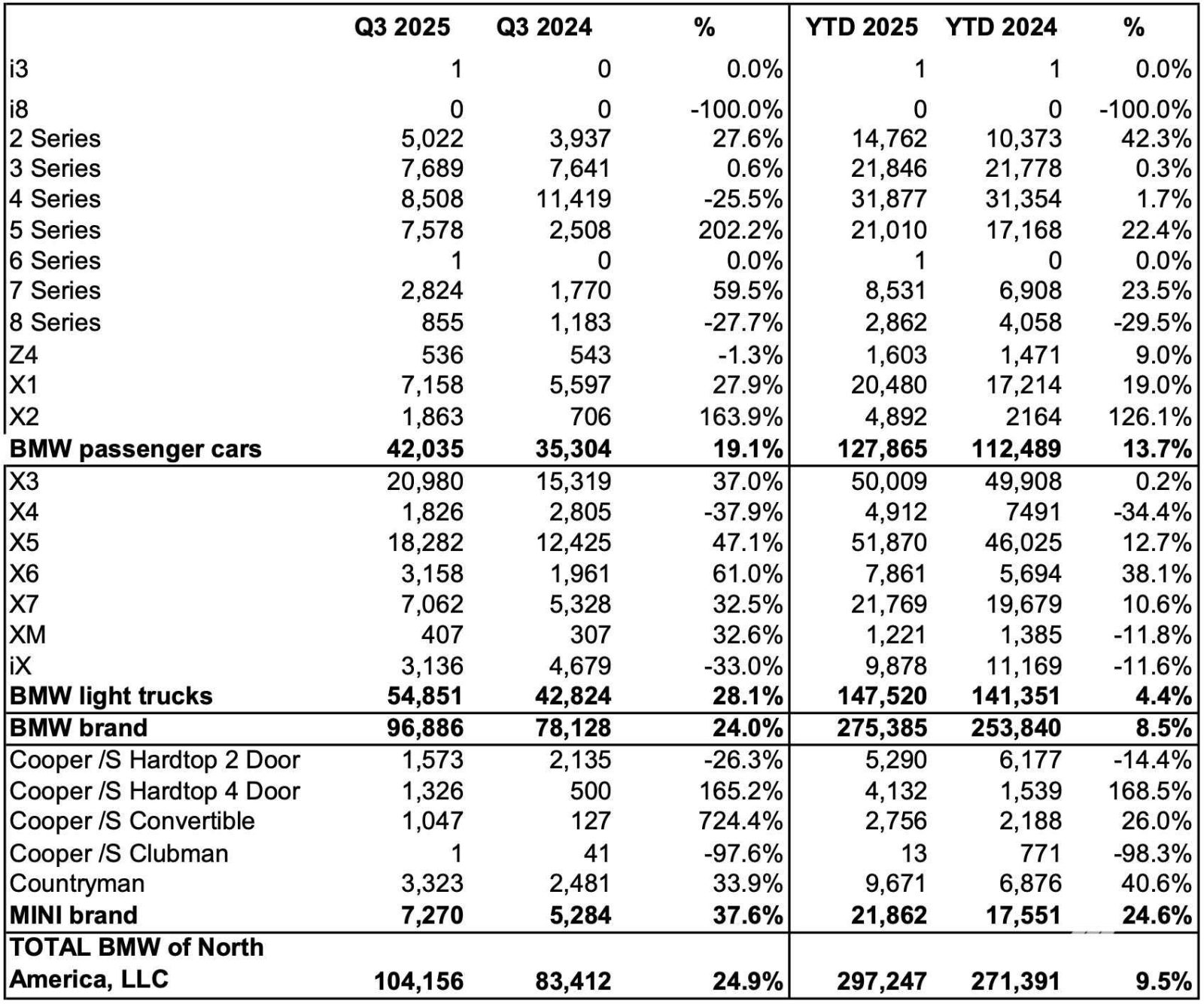

BMW of North America posted a robust Q3 2025, transferring 96,886 automobiles—up 24% year-over-year. Yr-to-date, the model has delivered 275,385 items, an 8.5% acquire that places BMW on observe to surpass final 12 months’s document U.S. gross sales. MINI’s refreshed lineup delivered a good sharper surge, with Q3 gross sales up 37.6% to 7,270 items and year-to-date quantity up 24.6%.

The combination tells the broader story. Passenger automobile gross sales rose 19.1% (42,035 items), whereas gentle vehicles—anchored by the X household—jumped 28.1% (54,851 items). However beneath the headline development lies a notable plateau in EV momentum. Electrified BMW gross sales (BEV + PHEV) slipped 2.8% in Q3, right down to 16,096 from 16,557 in 2024, whilst EVs now characterize practically 20% of BMW’s U.S. complete.

CEO Sebastian Mackensen pointed to the energy of BMW’s various portfolio heading into the ultimate stretch of 2025. But the slight electrified decline raises questions on provide bottlenecks, altering incentives, and growing competitors from each legacy rivals and EV startups.

How Q3 2025 Stacks Up Traditionally

To grasp the quarter’s significance, it helps to look again.

- Q3 2025 (96,886) stands effectively above Q3 2024 (78,128), marking a pointy rebound.

- In comparison with Q3 2023 (~99k), BMW is simply shy of its peak.

- In opposition to Q3 2021 (~85k) and Q3 2020 (~88k), this 12 months’s quarter is decisively stronger.

Trying Forward: Neue Klasse and the EV Shift

The outcomes reaffirm BMW’s resilience in its ICE-heavy lineup, however in addition they spotlight the strategic significance of Neue Klasse. With manufacturing slated to start in 2026, BMW might want to reignite EV development within the U.S. to keep up its management. Till then, count on incremental updates—expanded i5, iX2 availability, and improved charging ecosystems—to fill the hole.

Q3 2025 reveals BMW Group in America at a excessive level, but additionally at an inflection. Progress is powerful, demand is wholesome, and the portfolio is deep. But the EV slowdown, nonetheless slight, hints at greater questions for the years forward.

Source link